In December 2015, the share price of First Bank of Nigeria Limited was trading around N4.8 band. About seven years later, precisely last December, the value held tightly to N15, growing by over threefold amid general asset and economic doldrums.

The steep rise in the valuation of the financial institution deviates remarkably from the average performance of FUGAZ, an acronym describing the top five Nigerian banks by market capitalisation. In the past seven years, the share prices of the leading banks appreciated by an average of 90 per cent as against over 200 per cent growth seen in FirstBank.

Deflated by the bank’s exceptional performance, Access Holdings, GTCO, UBA and Zenith stocks posted about 60 per cent growth. The performance of the entire banking sector also flattens out when compared with FirstBank, which raises questions about the fundamentals of the bank and its growth trajectory.

In terms of inflation-adjusted return on investment, FirstBank shareholders are among the investors that emerged from the turbulent years with a positive real rate of return. Was it a stroke of luck? Does the market reward poor performance?

Of course, stocks sometimes thrive on mere greater fool theory, thus triggering an asset bubble. But the positive share movement of the premier bank is but only one of the many high growth indicators.

In first quarter of 2023, the bank’s non-performing loan (NPL) ratio came down far below the five per cent regulatory threshold, which means so much difference when placed in a historical context. As at December 2015, its NPL ratio was over 45 per cent, a telling reflection of the level of effort that went into cleaning its books in the intervening years. For analysts, the cleanup, which was done without raising fresh capital, explains what disciplined, focused and forthright leadership could achieve.

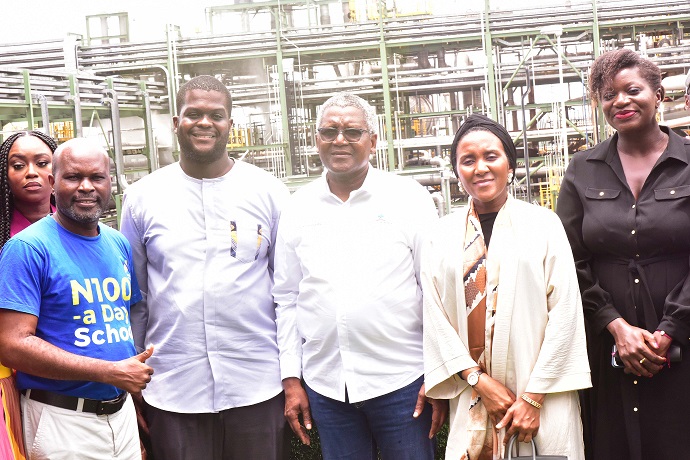

On cleanup process, the Bank CEO, Dr. Adesola Kazeem Adeduntan, said the institution was “its self-created AMCON”, referring to the Asset Management Corporation of Nigeria set up in the aftermath of the 2008 financial crisis to buy up the threatening toxic assets of Nigerian banks.

Indeed, what the management of the bank has done in the past seven years is not remarkably different from the role of AMCON, since its creation in 2011, except that the former raised fresh capital for its humongous responsibility whereas the bank did not. Also, the FirstBank experience was internal; and it did face a tougher task in terms of the proportion of its assets that had gone bad.

At the height of the financial crisis in 2008/2009, the NPL ratio rose to 37.3 per cent, from 9.9 per cent on record in 2007. On the other hand, the premier bank was carrying over 45 per cent NPL on its book as at January when Adeduntan took the reins of its leadership as the managing director.

All through the process, the bank did not raise fresh capital for the housecleaning programme, meaning the shareholders’ value was not diluted in the process.

Investors may have also kept in view other impressive qualitative metrics such as pre-tax return on equity (RoE), a measure of net income in proportion to shareholders’ equity, which moved from 0.6 to 17.3 per cent at the end of last year’s financial cycle. Also, pre-tax Return on Asset (RoA) climbed from 0.1 to 1.6 per cent while the cost of risk was also down to 1.7 per cent last year, from 10 per cent recorded in its 2015 financial.

At the end of this month, Adeduntan would have spent 7.5 years in office and he would be 30 months short of the tenure limit requirement. Already, he is the longest-serving chief executive of the institution, which is known for its short-term leadership tradition. Casual observers consider him as fortunate, but deep analysts think differently – the bank has been fortunate to have had him.

The lender, which predated ‘Nigeria’, and played the most active financial role in the structuring of the country’s pre- and post-Independence economy, may have just got its groove back under the current management. The books are clean and the NPL is trending downward, faster than the industry average. But beyond, its top and bottom lines are all out of the woods and climbing.

Its total assets, for instance, have increased by 167 per cent in the past seven years, meaning that its asset size has almost tripled, which also outperformed the industry growth. In terms of liquid asset to total asset ratio, it is also ahead of most of its peers. This suggests that while the quality of its assets has increased remarkably, with the NPL ratio falling by 88 per cent in less than a decade, the bank’s asset growth has not stalled, which speaks volumes about the quality of its risk management approach.

Currently, FirstBank had in its portfolio of about 41 million customer accounts, an extraordinary 276 per cent lift from its 2015 record. The figure is about 30 per cent of total bank accounts held by Nigerian banks. Customer depositors also jumped by as much as 153 per cent to 10.6 trillion.

The growth seen is also robbing off on the bottom line with the profit before tax (PAT) increasing by N137 billion in the period. That translates to over 1300 per cent, probably contributing majorly to the sudden spike in the share of the bank.

Perhaps, owing to its long history dating back to when banks were mostly associated with corporate and public sector financial infrastructure, FirstBank was mostly seen as a go-to for savers and borrowers. But that seems to have changed with its many smart digital channels. For its management, that is deliberate.

“Our goal is to transform the bank from lending-based to a transaction-based financial institution,” the chief executive pointed out.

Yes, its transformation is no longer a dream. From zero share of corporate e-bill payments, it has shoved its competitors behind to take hold of 42 per cent of the market. The bank, in the words of its managing director, has pivoted from brick and mortar to “brick and click”, making payment seamless and a click away for individuals, corporate as well as public entities.

“We have built a very formidable trade and cash management platform that we call FirstDirect, which allows corporate banking customers, from the comfort of their home, to initiate a trade transaction and complete it. You have a single view, giving you an interface where you can add your different accounts and transact,” Adeduntan explained.

FirstMobile, a standalone digital bank, has also emerged as a household name in the financial technology ecosystem. In 2015, when the platform was still at its teething age, its users were about 60,000 a number that soared to over six million (a growth of over 10,000 per cent). That has contributed immensely to the changing tradition of banking with FirstBank, as about 85 per cent of its transactions are now initiated via digital windows.

FirstMobile appears to have hit the bull’s eye in the bank’s reinvention drive and effort to appeal to younger demographics. But the platform itself is merely one of the potpourris of telecommunication-driven initiatives it has taken on to get the young depositors on board. FirstOnline users have also grown from about 90,000 to over one million within the timeframe just as its USSD, which targets feature phone users, is even more successful with users increasing by close to 3,000 per cent in seven years to 14.7 million.

Overall, its digital banking has evolved in both volume and public impression. Ease, convenience and reliability have moved the customer base from its tiny 0.6 million to 22 million.

Indeed, FirstBank is transmuting into a transaction-led institution. Last year, the volume of transactions hit 17 million, 8.5 times what it was in 2015 when it experienced some corporate turbulence. But the growth is not only in volume terms, as its non-interest income ratio hit 40.6 per cent for the first time last year, which aligns with the strategic direction of the current management in weaning the group from excessive credit risk exposure.

Over the years, most Nigerian banks have consolidated their global outlook. FirstBank has led the pack with its 40-year United Kingdom subsidiary, which is bigger than some of its competitor wholesale operations back home. But some of the pro-offshore Nigerian banks had been accused of extroversion and ego-seeking as most of the outposts were nothing but cost centres.

In the past few years, the assumption has been deflated; and the performance of the African subsidiaries of FirstBank is among what could be changing the tide. Before the 2015 change of the guard, the subsidiaries’ operations left had created a gaping hole in the PBT of the consolidated account. Last year, they contributed a combined 21.3 per cent to the group’s pre-tax profit.

But that was not because there was no risk out there. In the heat of the Ghanaian government debt crisis, Adeduntan revealed, FirstBank took the least impairment among Nigerian banks that were exposed to the crisis “not because we saw it coming but because we have consistently done the right thing and adopted best risk management practice”.

There is also a humane side to his management approach. Today, FirstBank is among the highest-paying Nigerian banks and offers the most attractive conditions of service, including training, accelerated career growth and many more. In 2021, its efforts were compensated with the Great Place to Work Award. Today, the once-touted conservative bank is attracting young and upwardly mobile professionals with the average age of its employees estimated at 39 years.

Being the longest-serving managing director of the pre-colonial financial behemoth, Adeduntan has the leverage of time and experience to enforce its transformational agenda. But he had also prepared for the job. At KPMG where he co-pioneered the firms’ financial risk management advisory services, he trained in almost all areas of human endeavors – presentation, people management, business writing and all sorts. On assumption of office, he was bold and firm in his decision to headhunt, institute new work culture, clear career growth blockages and challenged the status quo.

His courageous outing in the past seven and half years has transformed an institution once considered one of least prepared for the age of “brick and click” banking into the Usain Bolt of the emerging financial technology space.

Culled from Guardian Newspaper